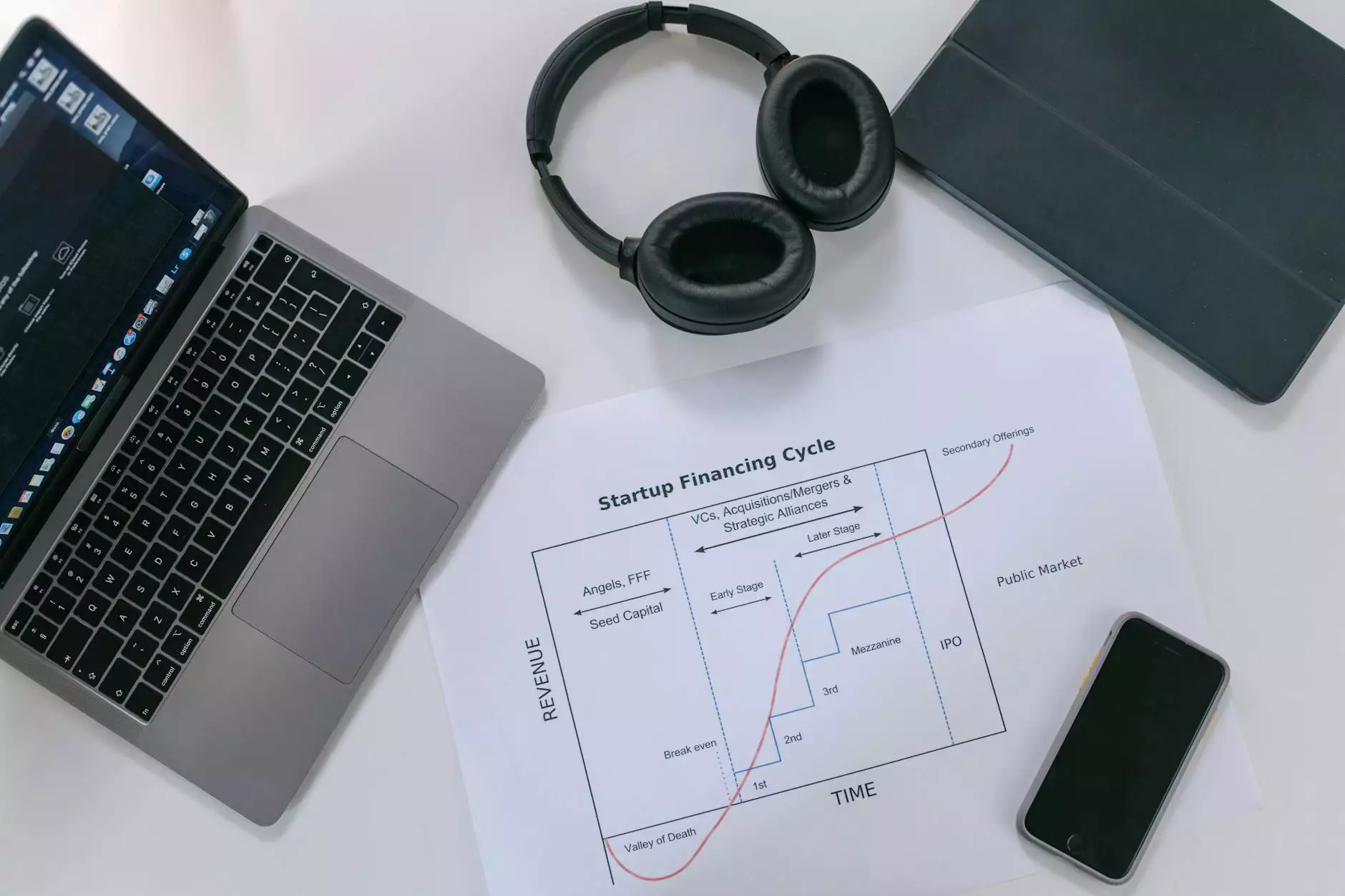

Start Prop: Your Guide to Achieving Financial Success

In today’s fast-paced financial landscape, understanding how to start prop can be a transformative step toward financial independence. Whether you are an aspiring entrepreneur or an established investor, diving into the world of financial services offers numerous opportunities to grow wealth and secure a prosperous future. This comprehensive article will guide you through the intricate pathways of starting a prop business, ensuring every step you take leads to sustainable success.

Understanding the Concept of Prop Trading

To truly start prop, it's essential first to grasp the concept of prop trading. Proprietary trading, often shortened to prop trading, involves financial institutions trading financial instruments, such as stocks, bonds, currencies, and derivatives, using their own funds. The goal is to generate profits for the firm rather than earning commissions by trading on behalf of clients.

Why Choose Prop Trading?

There are several advantages to pursuing a career in prop trading:

- High Profit Potential: Traders can earn significant bonuses and shares of the profits they generate.

- Access to Capital: Prop firms provide the necessary capital to traders, allowing them to leverage their skills without risking personal funds.

- Training and Development: Many prop trading firms offer training programs to enhance the traders’ skills, ensuring that they are well-prepared for the markets.

- Flexible Trading Strategies: Traders can employ various strategies, from day trading to more sophisticated long-term strategies, based on their expertise and market conditions.

Steps to Start Your Prop Trading Career

Starting a career in prop trading requires careful planning and execution. Here’s a detailed roadmap to help you start prop on the right foot:

1. Acquire Knowledge and Skills

Before jumping headfirst into the trading world, you must equip yourself with essential knowledge and skills. Here are key areas to focus on:

- Market Fundamentals: Understand financial markets, including how different asset classes operate.

- Technical Analysis: Learn how to analyze charts, trends, and patterns to make informed trading decisions.

- Risk Management: Develop strategies to manage risk effectively, ensuring you protect your capital.

- Trading Psychology: Cultivate the mental discipline and emotional resilience needed to navigate the volatile trading environment.

2. Develop a Trading Strategy

Your trading strategy should reflect your individual style, risk tolerance, and market conditions. Here are a few aspects to consider:

- Time Frame: Decide whether you want to be a day trader, swing trader, or long-term investor.

- Types of Trades: Define whether you’ll engage in technical trading, fundamental analysis, or a mix of both.

- Entry and Exit Points: Establish criteria for entering and exiting trades based on data-driven analysis.

- Backtesting: Test your strategy using historical data to ensure its viability before committing real capital.

3. Find the Right Prop Firm

Choosing the right proprietary trading firm is crucial for your success. Here are characteristics to look for:

- Reputation: Research the firm’s history, track record, and reviews from other traders.

- Training Programs: Look for firms that provide comprehensive training and mentorship opportunities.

- Profit Sharing Structure: Understand how profits are split and what you can reasonably expect in terms of earnings.

- Capital Contribution: Many prop firms require some form of capital contribution. Make sure you know the requirements upfront.

Building Your Portfolio: Diversification is Key

Once you start prop, building a diverse investment portfolio is crucial. Diversification helps mitigate risk and can lead to more stable returns. Here are some tips for effective portfolio management:

1. Asset Allocation

Determine the optimal allocation of assets in your portfolio. A typical allocation might include:

- Stocks: Equities can offer high returns but come with volatility.

- Bonds: Fixed income can provide stability and regular returns.

- Real Estate: Consider incorporating real estate investments to diversify your revenue streams.

- Cash or Cash Equivalents: Keeping a portion liquid can help you capitalize on market opportunities swiftly.

2. Regular Reviews and Rebalancing

Periodically review your portfolio to ensure it aligns with your long-term financial goals. Rebalance by selling assets that have grown disproportionately and buying more of those that have underperformed, while reassessing your allocation strategy based on market conditions.

Leveraging Technology in Your Prop Trading Journey

In the digital age, leveraging technology can significantly enhance your trading efficiency. Here's how:

1. Trading Platforms and Tools

Utilize advanced trading platforms that offer:

- Real-Time Data and Analysis: Access comprehensive market data and analytical tools.

- Automated Trading Systems: Consider algorithmic trading systems that execute trades based on predefined criteria.

- Risk Management Tools: Use software that helps in setting stop-loss and take-profit points effectively.

2. Continuous Learning and Adaptation

The trading landscape is ever-changing, and continuous learning is essential. Engage with online courses, webinars, and trading communities to stay updated with the latest trends, strategies, and technologies.

The Importance of Networking in Prop Trading

Networking is a powerful tool in the trading world. Building connections with other traders can provide valuable insights and opportunities. Here are ways to enhance your networking:

- Join Trading Communities: Participate in forums and groups focused on trading strategies and market discussions.

- Attend Conferences: Engage in industry events where you can meet experts and fellow traders.

- Mentorship: Seek out mentors who can provide guidance, share experiences, and assist in your career development.

Conclusion: Start Prop for a Brighter Financial Future

Embarking on your journey to start prop in financial services is an exciting venture laden with opportunities for growth and financial freedom. By acquiring the right knowledge, developing a robust trading strategy, choosing the best prop firm, diversifying your portfolio, leveraging technology, and actively networking, you can position yourself for long-term success. Remember, the key to thriving in the world of proprietary trading lays not just in your skills or strategy but in your willingness to learn, adapt, and persist. Your financial future is in your hands; take the first step today.